Greetings, my financially curious primates!

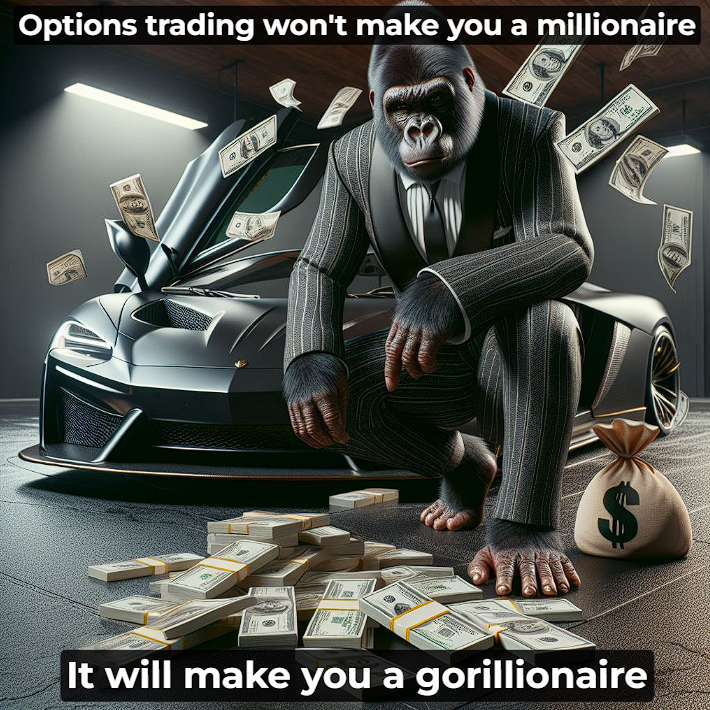

It’s Kuba Pudding Jr. here, your jungle-certified investing guru, ready to teach you the fine art of stock options trading—because why settle for regular stock trading when you can add more risk, more reward, and more reasons to dramatically thump your chest in victory (or despair)?

Now, if you’re wondering, “Kuba, why should I care about stock options?” let me ask you this: Would you rather buy a whole banana plantation, or just have the right to buy it later at a set price, betting that banana demand is about to skyrocket? If you picked the second option, congratulations—you’ve just grasped the basics of options trading.

Let’s swing into the details!

1. What Are Stock Options?

A stock option is a contract that gives you the right (but not the obligation) to buy or sell a stock at a specific price before a certain expiration date. Think of it like reserving a bunch of bananas at today’s price, hoping that in a few weeks, they’ll be worth way more (or less, if you’re betting the other way).

There are two main types of options:

- Call Options 🦍📈 – You’re betting the stock price will go up. It gives you the right to buy at a set price before expiration.

- Put Options 🍌📉 – You’re betting the stock price will go down. It gives you the right to sell at a set price before expiration.

Gorilla Tip: If you ever get confused, just remember: Call = You want to climb higher. Put = You’re ready to drop.

Helpful resource: What Are Stock Options?

2. How Do You Make Money with Options?

Options trading isn’t just about guessing the direction of a stock—it’s about making strategic moves like a master chess-playing gorilla (which, by the way, I am). Here are three main ways to make money with options:

- Buy Calls (Go Long) 📈 – If you think a stock is going up, buy a call. If the stock price rises above your strike price, you can buy it cheap and sell for profit!

- Buy Puts (Go Short) 📉 – If you think a stock is tanking, buy a put. If the stock price drops below your strike price, you can sell high and buy back low!

- Sell Options (Be the House) 🏦 – You can also sell calls or puts and collect the premium from traders who think they’re smarter than you. Just be careful—this strategy can backfire if the market swings wildly (trust me, I’ve seen King Kong lose big on this).

Gorilla Wisdom: The stock market is like a jungle. The strongest apes don’t just react—they plan ahead.

Helpful resource: Beginner’s Guide to Options Trading

3. How to Pick the Right Options

Not all bananas are the same—some are green and unripe, while others are perfectly golden and ready to flip for profit. Here’s how to pick the best options:

✅ Look at the Expiration Date – The longer the time, the more expensive the option, but the more time you have for your prediction to be right. Choose wisely.

✅ Check the Strike Price – If you’re buying a call, pick a strike price close to the current stock price so it has a better chance of going up.

✅ Analyze Volatility – Stocks that move wildly can be great for options traders—more movement means more opportunity (but also more risk).

Gorilla Tip: If an option is too cheap, it’s usually for a reason—like a banana left out in the sun too long.

Helpful resource: How to Choose the Right Stock Options

4. Risk Management: Don’t Be a Reckless Ape

Options trading can make you rich or leave you crying into a pile of banana peels. Follow these golden jungle rules to avoid disaster:

🚫 Never bet everything on one trade – Even the best traders lose sometimes. Don’t be like my cousin who gambled his entire banana stash on a single call option.

🚫 Set a Stop-Loss – Know when to walk away. If a trade goes bad, cut your losses before it wipes you out.

🚫 Don’t Chase FOMO – Just because everyone’s buying call options on some hyped-up banana company doesn’t mean you should, too. Think for yourself!

Gorilla Wisdom: You don’t need to win every trade—you just need to win more than you lose.

Helpful resource: Options Trading Risks & Strategies

5. Advanced Strategies for Gorilla-Level Traders

Once you’re comfortable with the basics, try these advanced strategies to level up your trading:

🦍 Covered Calls – If you own a stock, sell call options on it to make extra income.

🍌 Iron Condor – A fancy way to profit from a stock staying within a certain range (perfect for cautious apes).

🚀 Straddle & Strangle – Bet on volatility by buying both a call and a put—perfect when you expect big swings but don’t know which way.

Gorilla Tip: The best traders think three moves ahead—not just about where a stock is going, but how to profit in different scenarios.

Helpful resource: Advanced Options Trading Strategies

Final Thoughts: Trade Smart, Trade Strong

Stock options trading isn’t just about making money—it’s about playing the game wisely. Some days, you’ll feel like a king of the jungle. Other days, you’ll feel like you got hit by a falling coconut. The key is to keep learning, manage your risks, and trade with confidence.

And if all else fails? Just remember the words of my wise friend Rhesus, the candy mogul:

“Give them what they want, and they’ll want what you give them.”

So get out there, trade smart, and may your call options always go up and your put options print cash!

Chest thumps and banana profits,

Kuba Pudding Jr.

Your stock market-savvy silverback

P.S. If you make a successful options trade, send me a GIF of you doing a victory chest thump—I always love a good success story.

Leave a Reply